BOSTON, Nov. 29, 2022 /PRNewswire/ -- A key requirement for every company in the polymer value chain is to develop and deliver a sustainability roadmap. The market drivers are becoming more significant, and industry activity is responding accordingly. There are an emerging number of solutions, but in many cases, the economic and environmental viability remains unfounded. IDTechEx covers sustainable polymers in detail through both alternative feedstocks, bio-based and CO2, and recycling to achieve a circular economy. This article will highlight some of the key news in 2022 and what to look out for in 2023.

The market drivers influencing the progression to greater sustainability across the polymer industry come from four main entities: governments (through regulation), retailers or brands, non-governmental organizations (NGOs) or equivalent, and the public. Lobbying, investments, pledges, consumer spending habits, and more all play a role, but it is likely regulation and how they are monitored and enforced that will be the most significant. Regional and national announcements are increasing, as shown by a greater ban on single-use plastic in Japan, Australia, and elsewhere.

IDTechEx has three leading reports on sustainable polymers covering the recycling of plastic waste and assessing the use of bio-based and CO2 feedstocks. Each of these solutions has a range of technical challenges, not to mention questions on the environmental and economic viability. For one, crude oil prices have been exceptionally turbulent, presenting obvious challenges. The success of all approaches will depend not only on the product properties but also on the "green premium" and the ability to decouple prices from the incumbent raw materials.

Plastic Recycling

Recycling is critical in establishing a truly circular economy. Expectedly, mechanical recycling processes continue to progress, but throughout 2022 and continuing into 2023, significant industrial activity has and will surround chemical recycling - most notably in depolymerization and pyrolysis projects. This remains controversial, with NGOs accusing players of "greenwashing" and petrochemical giants leveraging third-party life cycle assessments and championing this as the key piece of the puzzle. This debate will rage on. IDTechEx reviews the claims in its latest report on "Chemical Recycling and Dissolution of Plastics 2023-2033" but ultimately thinks that there is a beneficial role for these processes, although perhaps overstated by many. The tailwinds are so great that significant mid-term growth is inevitable though still modest relative to the full scale of the annual plastic waste production.

In 2022, there have been major commercial developments. Eastman announced that they would invest up to US$1 billion in a polyester depolymerization plant; Carbios is heading towards its first industrial enzymatic depolymerization plant in partnership with Indorama and has closed agreements with On, Patagonia, PUMA, and Salomon; Encina announced a US$1.1 billion investment in a new pyrolysis plant; Plastic Energy progressed in their commercialization with announcements surrounding TotalEnergies, INEOS, LyondellBasell, and Qenos; Similarly, Honeywell announced a strategic agreement with TotalEnergies and a JV with Avangard. The list of strategic partnerships, projects, offtake agreements, investments, and products is extensive. However, it has not all been good news for advocates of chemical recycling. The regulatory discussion has ramped up looking at the US alone. Over 100 letters from lawmakers and environmental groups were delivered to the Environmental Protection Agency EPA concerning how this is regulated. In terms of projects, there have been setbacks with Brightmark Energy scrapping plans for a US$680 million plant, for example. Prepare for a lot more news in 2023.

Bioplastics

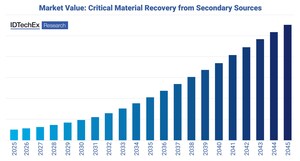

Substituting fossil feedstocks with biological alternatives like corn sugar, castor oil, or woody biomass can reduce the carbon footprint of polymer manufacturing. Bioplastics manufacturers are scaling production rapidly, and IDTechEx expects the industry to grow by 10.1% CAGR in the next ten years.

2022 has been a particularly significant year for bio-based nylon. Historically, producing nylon from the fermentation of sugars has been a string of unsuccessful start-ups. Yet this year, biotech company Genomatica and partner Aquafil achieved demonstration-scale fermentation production of nylon-6. Companies like Asahi Kasei and Lululemon have quickly signed partnerships with the company as a result. The bioplastic industry has also made progress with new bio-based products for polyolefins, polyurethanes, and polyhydroxyalkanoates (PHAs).

In 2023, expect several investments from bioplastics manufacturers to come to fruition and bioplastic production capacity to expand rapidly as many plants are set to open. In plastic bottle packaging, a critical milestone will be met. 2023 will see the first-ever commercial-scale production of polyethylene furanoate (PEF). This rising star plastic is seen as an alternative to the incumbent plastic bottle material, polyethylene terephthalate (PET). While PET has been partially bio-based for years, it is limited to a bio-based content of around 30%, still relying heavily on petrochemical feedstocks.

In contrast, PEF can be 100% bio-based, and while the two materials have similar molecular structures, PEF offers superior properties. Elsewhere, PHAs, another class of rising star bioplastics, will also expand considerably, with a new plant expected to open by RWDC. Brand owners are keenly watching the PHA industry. This plastic is entirely fermented from bacteria and has a wide spectrum of potential applications, as Bacardi launches its new bottles made from PHA in 2023.

In the report "Bioplastics 2023-2033: Technology, Market, Players, and Forecasts", IDTechEx tracks the huge bioplastics industry activity that has been taking place and discusses the trends and challenges surrounding bioplastics. The report considers 13 different bioplastic categories in a comprehensive ten-year forecast and discusses the key applications for these materials.

CO2-Derived Plastics

Carbon Capture and Utilization (CCU) technologies are an alternative to the conventional production of primary chemicals, specialty fine chemicals, and polymers. The value proposition is to create a circular carbon economy, where CO₂ is captured from industrial point sources or the ambient air and then used as a recycled carbon source for chemical production.

As demonstrated by players' activities, awareness and commercial momentum are building for CO₂ utilization technologies. The UK-based Econic Technologies announced two major licensing deals in 2022 with leading polyol producers in China and India. Econic is commercializing a catalyst and process technology that incorporates CO₂ into polyol components for polymer manufacturing CO₂, initially serving the polyurethane industry.

The Illinois-headquartered LanzaTech is expected to be the first CCU company to go public via a business combination with AMCI Acquisition Corp. II. LanzaTech transforms waste carbon into chemical building blocks for materials and sustainable fuels using a proprietary engineered bacterium. The company has fostered multiple partnerships with incumbents in textile and packaging and has recently struck a deal with Brookfield Renewable Corp for US$500 million to finance upcoming projects.

The recent IDTechEx report "Carbon Dioxide (CO₂) Utilization 2022-2042: Technologies, Market Forecasts, and Players" analyzes the prospects and challenges of Carbon CCU solutions in chemical and polymer manufacturing.

The bottom line is the climate benefits of these sustainable solutions. Recycling and alternative feedstocks need to be assessed on a case-by-case basis. The market potential for sustainable polymers is huge, and momentum is certainly behind it. As single-use plastic bans and carbon zero pledges grow in tandem with plastic consumption, the pressure is ever-increasing for materials producers and consumers to transition to more sustainable practices. IDTechEx expects the plastic circular economy to continue gaining traction as sustainability increasingly becomes a corporate and consumer priority. Yet it still has a long way to go before it majorly impacts the existing petrochemical industry.

Find out more about IDTechEx's sustainable plastics portfolio and other IDTechEx research by visiting www.IDTechEx.com/Research. Sample pages are available for all IDTechEx reports.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.

Images Download:

https://www.dropbox.com/scl/fo/014k2muv4hhkllh52wotg/h?dl=0&rlkey=bjl3rao44yc8oh7mpcnf1951p

Media Contact:

Lucy Rogers

Sales and Marketing Administrator

press@IDTechEx.com

+44(0)1223 812300

Social Media Links:

Twitter: www.twitter.com/IDTechEx

LinkedIn: www.linkedin.com/company/IDTechEx

Facebook: www.facebook.com/IDTechExResearch

Photo: https://mma.prnewswire.com/media/1957869/IDTechEx_Dissolution_Chemical.jpg

Logo: https://mma.prnewswire.com/media/478371/IDTechEx_Logo.jpg

Share this article