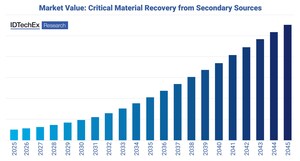

BOSTON, April 11, 2024 /PRNewswire/ -- The chemical sector alone is responsible for 2% of global anthropogenic CO2 emissions, and the industry depends heavily on finite fossil fuel feedstocks. The new IDTechEx report, "Carbon Dioxide Utilization 2024-2044: Technologies, Market Forecasts, and Players", explores how captured CO2 could be utilized as a feedstock for hundreds of different chemicals instead. Valorizing waste carbon dioxide has already proven profitable in the chemicals industry for polycarbonate polymers. Overall, IDTechEx forecasts revenue from CO2-derived polymers and other drop-in chemicals will exceed US$47 billion in 2044.

Why is CO2 utilization in chemical production important?

Carbon capture is viewed as a key technology for achieving net-zero goals as it can decarbonize hard-to-abate sectors. However, carbon capture technologies are expensive, and regulatory pressure to decarbonize remains weak worldwide. If captured carbon can be utilized to make profitable chemical products, this revenue stream can provide an economic incentive to accelerate the uptake of CCUS (carbon capture, utilization, and storage) technologies until legislation that promotes CO2 storage emerges.

While many CO2-derived chemicals do not always represent net-negative or net-zero products, they do still represent reductions in emissions compared to the fossil fuel-based status quo and should not be overlooked as a decarbonization tool.

For more information on capturing CO2, particularly for hard-to-abate sectors such as cement, please refer to the "Carbon Capture, Utilization, and Storage (CCUS) Markets 2023-2043" market intelligence report.

CO2 utilization in chemicals is already profitable

Utilizing captured CO2 to make chemicals is not a far-fetched fantasy. Profitable production of CO2-derived polymers has quietly been around for decades. One of the pioneers was Asahi Kasei, which commercialized a process making aromatic polycarbonates from waste CO2 in 2002. Since then, the total annual production capacity of polycarbonate resin using this technology has reached about 1 million tonnes.

Similarly, Aramco Performance Materials has developed polycarbonate polyols ('Converge' polyols) containing up to 40% CO2, which can be used in industrial applications, including coatings and foams. In January 2024, Aether Industries, H.B. Fuller, and Saudi Aramco Technologies announced the commercialization of these polyols. Moreover, German materials company Covestro uses CO2 to produce polycarbonate and isocyanate (polyurethane precursor), and UK-based Econic Technologies recently unveiled new technology for memory foam mattresses based on captured CO₂ emissions.

High CO2 prices can be tolerated using these methods, and players have reported improved material performance. However, the product volumes and the CO2 utilization ratio in polymer manufacturing are relatively small, limiting its CO2 utilization potential. Production growth is, therefore, likely to continue to be driven by superior performance instead of CCUS regulation or voluntary carbon credits.

The existing routes to CO2-derived polymers and polymer precursors all generally rely on the same simple chemical idea: break as few strong carbon and oxygen bonds in CO2 as possible. This non-reductive approach results in a lower energy demand and, crucially, no clean hydrogen requirements.

The hydrogen bottleneck

But what about making chemicals containing many hydrogen-to-carbon bonds? Currently, clean hydrogen production is expensive and can raise costs significantly compared to fossil-based chemicals. Green hydrogen economics are only expected to improve significantly in the 2030s (driven by reductions in the price of renewable energy and improvements in electrolyzer technology), but chemical production from captured CO2 and H2 should not be written off completely in 2024.

For the full portfolio of hydrogen research from IDTechEx, please visit www.IDTechEx.com/Research/Energy.

One innovative approach is to utilize captured industrial emissions that already contain CO2 and hydrogen (such as steel mill off-gases). CO2-derived ethanol producer, LanzaTech, already has several commercial plants using this very approach. Such sources of waste hydrogen have been crucial for scaling up CO2-derived chemicals in the short term. Another example is Carbon Recycling International's first commercial-scale emission-to-liquids plant, which used hydrogen emitted from coke production to create CO2-derived methanol.

High-value diamonds and nanotubes represent future application areas

Pure carbon products such as graphene, carbon nanotubes, and carbon nanofibers have promising applications in construction, energy storage, consumer electronics, water filters, and fuel cells. Typically manufactured via chemical vapor deposition of hydrocarbon gases, the low conversion efficiency and high cost of this approach has inspired ongoing research into alternative synthesis pathways.

Electrolysis of molten salts using captured CO2 as a starting material is being pursued by companies such as SkyNano, Carbon Corp, Bergen Carbon Solutions, UP Catalyst, and Saratoga Energy. This is one of the few CO2 utilization pathways that can tolerate direct utilization of flue gas without purification/pre-concentration steps being needed. However, green electricity is required, the volumes of CO2 utilized remain small compared to global anthropogenic emissions, and this technology is yet to be demonstrated at a large scale.

For climate-conscious romantics, waste CO2 can even be utilized for engagement rings. Startups Aether Diamonds and Skydiamond offer stones made from CO2 captured directly from the atmosphere.

Challenges remain

The chemical industry is a highly interconnected, integrated industry and has been optimized over decades. If this system is to be fundamentally changed to run on CO2 rather than on fossil feedstock, decisions to preserve, repurpose, or replace industrial assets need to take place soon. Industrial demonstrations need to ramp up. Cheap, low-carbon electricity needs to become widely available. A full account of emissions and embedded carbon in the chemical industry supply chain must be routine through carbon management.

Major concerns associated with investing and developing carbon dioxide utilization technologies to produce chemicals remain as (1) the quantity of CO2 utilized is small compared to the amount of CO2 being emitted globally, and (2) the energy required to transform CO2 into commercial products could significantly reduce the net economic and environmental benefits of utilization methods without an associated scale-up of low-cost green electricity.

To find out more about the new IDTechEx report "Carbon Dioxide Utilization 2024-2044: Technologies, Market Forecasts, and Players", including downloadable sample pages, please visit www.IDTechEx.com/CO2U.

For more information on IDTechEx's energy and decarbonization market research portfolio, please visit www.IDTechEx.com/Research/Energy.

About IDTechEx:

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.

Image download:

https://www.dropbox.com/scl/fo/59fi7nsis44dy3t784gom/h?rlkey=hcavxaatu9uvx4ncfgc3b6loy&dl=0

Media Contact:

Lucy Rogers

Sales and Marketing Administrator

press@IDTechEx.com

+44(0)1223 812300

Social Media Links:

Twitter: www.twitter.com/IDTechEx

LinkedIn: www.linkedin.com/company/IDTechEx

Photo: https://mma.prnewswire.com/media/2381188/IDTechEx.jpg

Logo: https://mma.prnewswire.com/media/478371/IDTechEx_Logo.jpg

Share this article