BOSTON, May 26, 2023 /PRNewswire/ -- The desire for zero-emission power generation has seen solid oxide fuel cells (SOFC) touted as a possible solution. SOFC's capability to run on hydrogen and at a higher efficiency than alternative fuel cells when providing combined heat and power (CHP) is an enticing prospect, while fuel flexibility allows for a transition from hydrocarbons towards zero emission power generation as part of the hydrogen economy. The real question, though, is that with many opportunities for stationary power sources, which applications are key to the success of the solid oxide fuel cell industry?

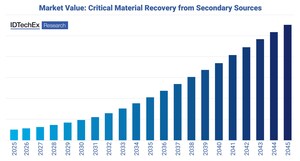

The new IDTechEx report, "Solid Oxide Fuel Cells 2023-2033: Technology, Applications and Market Forecasts", provides a comprehensive overview of the solid oxide fuel cell market, including an assessment of the key technology trends, major players and also includes granular 10-year market forecasts for solid oxide fuel cell demand (MW) and market value (US$), segmented by application areas. IDTechEx projects the market value to reach US$6.8 billion by 2033.

Due to high operating temperatures, ramp up/down times can be long for solid oxide fuel cells, while the associated large change in temperature can lead to degradation of ceramic components, specifically is there is a mismatch of thermal expansion coefficient between neighbouring components. As such, SOFCs are best suited to applications where continuous power output is required, and utility-scale power generation is one such market sector. Use of the generated thermal energy to provide heat and hot water to nearby facilities adds to the appeal of the overall system. The IDTechEx report details OEMs providing SOFC systems for zero emission utility scale power generation, partnerships that have been established with utility providers and key examples of case studies.

Similar to power generation for utility companies, SOFCs are well suited for utilization in commercial and industrial (C&I) applications where continuous operation is likely. Grid independence allows companies to operate with reliable power generation, even during power outages. A clear example of this ability can be seen with Walmart utilizing SOFCs provided by Bloom Energy to ensure supermarkets can remain open at all times, 24/7. An advantage for SOFCs in C&I applications is the ability to operate in CHP mode, enhancing efficiency with respect to competing alternative fuel cell technologies and providing heat directly to the commercial or industrial space. On the other hand, another energy-intensive application is data centers and telecommunication networks, but in these cases, CHP is not required as overheating of the servers is the main cause for concern with respect to temperature control. For this reason, several players have stated to IDTechEx that they will not pursue power generation for data centers as a viable application area for their SOFCs.

For on-grid residential applications, a suitable choice for backup power would be lithium-ion batteries charged from the grid. Batteries are more readily available and at a cheaper price point than low-power SOFCs. A drawback is the longer start-up time and few possible cycles for solid oxide fuel cells. With connection to the gas network, SOFCs can supply CHP on a continuous basis. Pairing with batteries allows a buffer to intermittent demand in residential applications. Japan is the most mature, and largest, market for residential CHP SOFCs. Off-grid operation, with on-site gas storage coupled with a SOFC can provide continuous power. The possibility of running the fuel cell in reverse (rSOC), powered by renewables such as solar, and producing hydrogen on site is an intriguing concept – allowing the fuel cell to then run on this generated fuel. However, the hydrogen must be stored on-site, a much less convenient fuel than a hydrocarbon. Off-grid applications are a small market with approximately 0.1% of people in high income countries living off-grid.

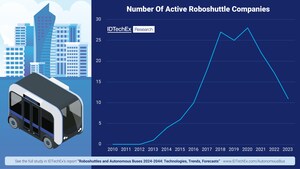

So, what is the future of the solid oxide fuel cell market? Partnerships have been announced for high volume manufacturing, due to come online within the next five years, with different companies targeting varied applications. In other cases, such as vehicles (including marine), limited success for SOFCs is expected, with alternative fuel cell technology (PEM) set to dominate. IDTechEx has produced granular 10-year market forecasts for the global SOFC demand (MW) and market value (US$) segmented by application area based on historical data and first-hand company interviews.

For more details on the SOFC technology, market trends, and key and emerging players, see the IDTechEx market report "Solid Oxide Fuel Cells 2023-2033: Technology, Applications and Market Forecasts".

For more information on IDTechEx's other reports and market intelligence offerings, please visit www.IDTechEx.com/Research.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.

Images Download: https://www.dropbox.com/scl/fo/msqrmoikz9c7q4vl2j0hg/h?dl=0&rlkey=3lpb7arhj41d4qqofiqtd7vmr

Media Contact:

Lucy Rogers

Sales and Marketing Administrator

press@IDTechEx.com

+44(0)1223 812300

Social Media Links:

Twitter: www.twitter.com/IDTechEx

LinkedIn: www.linkedin.com/company/IDTechEx

Facebook: www.facebook.com/IDTechExResearch

Photo: https://mma.prnewswire.com/media/2084143/ApplicationSOFC.jpg

Logo: https://mma.prnewswire.com/media/478371/IDTechEx_Logo.jpg

Share this article