Tectonic Gold Plc - Acquisition of Godolphin Exploration Limited

News provided by

Tectonic Gold Plc11 Apr, 2025, 06:00 GMT

TECTONIC GOLD PLC

("Tectonic" or the "Company")

Proposed acquisition of Godolphin Exploration Limited,

Approval of waiver of obligations under Rule 9 of the Takeover Code,

Share Consolidation,

Proposed Change of Name,

Board Changes

and

Notice of Annual General Meeting

Further to the announcement on 17 March 2025, Tectonic Gold plc (AQSE:TTAU), the metals exploration company, is pleased to announce that the Company has executed a conditional share purchase agreement (the "SPA") to acquire the entire issued and to be issued share capital of Godolphin Exploration Limited ("Godolphin"), a private exploration company focused on tin and copper exploration in the South West of England (Devon and Cornwall) (the “Proposed Acquisition”).

Highlights

- Proposed acquisition of Godolphin for c.£3.66m payable in shares, conditional on independent shareholder approval at the Annual General Meeting;

- Shift in metals exploration focus to tin and copper in the South West of England;

- Proposed change of name to Tamar Minerals plc;

- 20:1 share consolidation;

- Appointment of Mark Thompson to the Board

Proposed Acquisition of Godolphin

The consideration payable for the Proposed Acquisition will amount to approximately £3.66m payable by the issue of 1,832,127,500 shares in Tectonic (the "Consideration Shares") such that the shareholders of Godolphin will hold approximately 63.4% of the Enlarged Issued Share Capital of the Company following Completion. In addition, Godolphin Warrant Holders will have their Godolphin Warrants cancelled and will be issued with 6,962,500 Tectonic Warrants.

The Proposed Acquisition falls within the scope of Rule 9 of the Code. Shareholders representing 74.5% of Godolphin’s share capital have been deemed by the Panel to be Acting in Concert. Furthermore, certain members of the Concert Party hold 5.69% of the Company’s Existing Ordinary Shares. VSA Capital, which is a member of the Concert Party, will also receive 21,650,000 Existing Ordinary Shares held by Titeline Drilling Pty Ltd ACN (“Titeline”) (as detailed below) as consideration for its services in connection with the Proposed Acquisition and its role as AQSE Corporate Adviser. In aggregate therefore, following Completion, the Concert Party will hold approximately 49.90% of the Company’s Enlarged Issued Share Capital, which may be capable of increasing to 49.96% if the Tectonic Warrants were exercised as the Concert Party will hold 3,462,500 of the Tectonic Warrants. Details of the Concert Party are set out below. Under Rule 9 of the Code, when a person or group Acting in Concert acquires an interest in shares that results in them holding 30% or more of the voting rights, they are required to make a mandatory offer to acquire all remaining shares in the Company. However, the Takeover Panel has agreed to grant a Waiver of this obligation, subject to the approval of the Independent Shareholders of Tectonic. The Proposed Acquisition is therefore conditional upon, among other things, the approval of Shareholders at the Annual General Meeting (the “AGM”) of the Company to be held at 8.00 a.m. (UK time) / 5.00 p.m. (AEST) on 12 May 2025 at Level 3. 66 Hunter Street. Sydney. 2000. NSW. Australia.

Certain other resolutions will be proposed at the AGM as detailed below.

Information on Godolphin

Godolphin was founded by three individuals; its Executive Chairman, Mark Thompson, an acknowledged expert in the tin and copper markets, and a long-term proponent of the rebirth of the Cornish mining industry; David Lilley and Henry Maxey, both experienced commodities fund managers.

Its strategy is to acquire, digitise, and consolidate historical geological and mine data, alongside modern terrain data, satellite photography and geophysical information into a single database. With this data, the company intends to pursue additional mineral rights with the intention of undertaking exploration activities.

There has been little, large scale systematic modern exploration carried out in Devon and Cornwall since the end of the 19th Century mining boom. In May 2021 Godolphin entered into an exclusive license agreement for a 3-D model of 338 historic mines in Devon and Cornwall. This model is the work of many years of painstaking work to digitise historical records and mine closure plans of former tin and copper mines. Management has successfully identified and advanced numerous exploration projects worldwide and intends to bring this experience to bear in Devon and Cornwall.

The value of the company results from the years of detailed data acquisition, together with successful identification and acquisition of options over two attractive assets:

• Devon Great Consols (copper-tin, potentially with gold and silver credits)

• Great Wheal Vor (tin)

Devon Great Consols

Option Agreement – Devon Great Consols (“DGC”)

Godolphin Exploration Limited and Mr Andrew Law entered into an option agreement dated 21 May 2021 (the “DGC Option Agreement”), pursuant to which Andrew Law has granted to Godolphin the exclusive right to explore the Tavistock Woodlands Estate, Devon for a term of 120 months in order to assess the economic potential of the Property and to quantify mineral resources. Godolphin may conduct exploration work including, but not limited to, geological and geophysical surveys, drilling, excavating, use of explosives, pits, mineral sampling for laboratory analysis, samples for metallurgical tests and other supplementary works required to explore the Tavistock Woodlands Estate, Devon. Pursuant to the DGC Option Agreement and its exercise, Godolphin Exploration has the right to enter into a Mineral Lease over the rights related to the Tavistock Woodlands Estate, Devon. In consideration for the maintenance and ultimate exercise of the DGC Option, Godolphin is obligated to pay to Andrew Law the following indexed amounts (plus any applicable Value Added Taxes (“VAT”)):

| Year |

Annual License Fee (£) |

| 1 |

25,000 |

| 2 |

25,000 |

| 3 |

50,000 |

| 4 |

50,000 |

| 5 |

75,000 |

| 6 |

75,000 |

| 7 |

75,000 |

| 8 |

100,000 |

| 9 |

100,000 |

| 10 |

100,000 |

| Total |

675,000 |

Godolphin has made payments amounting, in aggregate, to £109,643.6 in connection with the DGC Option Agreement.

Mineral Lease Terms

Upon the exercise of the option and the entering into a Mineral Lease the following commercial terms will apply:

• An indexed annual certain rent of £100,000 per annum – this to be deductible against royalty payments

• 2.5% Net Smelter Return Royalty on tin when the price is below $30,000 per tonne

• 3.5% Net Smelter Return Royalty on tin when the price is between $30,000 and $35,000 per tonne

• 4.5% Net Smelter Return Royalty on tin when the price is above $35,000 per tonne

• 2.5% Net Smelter Return Royalty on copper when the price is below $10,000 per tonne

• 3.5% Net Smelter Return Royalty on copper when the price is between $10,000 and $15,000 per tonne

• 4.5% Net Smelter Return Royalty on copper when the price is above $15,000 per tonne

• 10% Net realizable Value on any lithium concentrate

• 3.5% Net Smelter Return on any other metallic mineral, excluding gold and silver

• 5% on the general return for non-metallic minerals and aggregates

Additional Mineral Rights

Godolphin Exploration will explore the possibility of acquiring rights over other mineral rights in the South West of England.

Property Map and Planning

Godolphin is planning to drill test the down plunge and along strike potential of the DGC Main Lode.

A previously mined portion of DGC is within the Tamar Valley Area of Outstanding Natural Beauty (“AONB”) and would require a planning application and permission to drill.

A significant High Grade Copper and Tin (Gold, Silver) Vein

The deposit is recognised as the largest copper sulphide vein system in Southwest England, with a recorded production history of 757,000 tonnes of copper ore. This highlights its significance as a major historical mining asset in the region. The geological dimensions of the system span 3.5 kilometers in length, with widths ranging from 2 to >10 meters. Historical mining activities reached a depth of 500 meters, indicating extensive vertical and horizontal development during its operational period.

The copper grades of the deposit varied over time. Initially, the mine produced exceptionally high grades of up to 14% copper, though this declined to around 4% by the time of its closure. Despite limited information on head grades, the quality of the ore in the early stages of mining suggests a highly lucrative deposit. Additionally, the scarcity of waste dumps in the area implies that much of the ore was directly shipped, likely due to its high-grade nature and minimal processing requirements.

The ore shoots within the deposit are interpreted to plunge, following a thermal gradient. This geological feature provides insight into the controls influencing mineral deposition and offers guidance for future exploration efforts. Tin mineralization was also identified but minimally mined in the deeper parts of Wheal Emma, indicating the deposit's polymetallic potential. Notably, in the 1970s, tin was successfully recovered from the reprocessing of old tailings, demonstrating the presence of valuable residual minerals in previously discarded material.

Waste dump samples from the site reveal significant grades of other minerals, further highlighting the deposit’s economic potential. Analysis of these samples has shown concentrations of up to 4.15% tin (Sn), 1.63% tungsten trioxide (WO₃), 0.44 grams per tonne of gold (Au), and 19 grams per tonne of silver (Ag). These findings suggest that even the waste material contains high-value minerals that could justify reprocessing. The deposit has not been subjected to modern drilling techniques since its closure in 1903, leaving much of the DGC Main Lode unexplored. This represents a significant opportunity for contemporary exploration and development using advanced technologies.

DGC Main Lode - Long Section Through Old Workings

In the late 1970s, Cominco made an attempt to explore the DGC Main Lode by drilling three holes. However, none of these drill holes successfully intersected the target lode due to excessive hole deviation. As a result, no further drilling has been conducted at the DGC Main Lode since then, leaving its potential unexplored.

Godolphin is now planning to test the unmined down-plunge and along-strike potential of the DGC Main Lode, initially outside the boundaries of the Area of Outstanding Natural Beauty (AONB). This exploration is aimed at evaluating previously untapped sections of the lode that may host significant mineralization.

Further drilling underneath the old mine and within the AONB will be undertaken upon receipt of planning consents.

Devon Great Consols – Geochemistry

In the 1970s sampling of old shaft waste dumps from the DGC system revealed consistently anomalous levels of tin (Sn), with values reaching up to 0.37% Sn. This early sampling provided evidence of tin mineralization within the deposit. A more recent sampling campaign conducted by Godolphin confirmed similar tin values, with one sample exceeding 1% Sn, indicating the presence of high-grade tin mineralization in certain areas of the system.

Samples collected by both Cominco and Godolphin also demonstrated the presence of silver (Ag) and gold (Au) at levels that may be significant enough for by-product recovery. This could add further value to the deposit, suggesting the potential for a polymetallic extraction strategy.

The correlation between copper (Cu) and tin (Sn) values was found to be poor, which suggests that the two metals were deposited during separate phases of mineralization. This observation highlights the complexity of the mineralizing processes in the DGC system and implies that different parts of the structure may host distinct types of mineralization.

The sampling results confirm the presence of tin within the DGC system. Geological evidence suggests that the tin-rich portions of the structure are likely to be found at greater depths and down-plunge, closer to the granite contact. This is consistent with other large copper-tin systems in Cornwall where the tin underlies a polymetallic or copper zone. This provides a clear direction for future exploration targeting high-grade tin zones within the deposit.

Great Wheal Vor

Option Agreement – Duke of Leeds Mineral Rights Estate including Great Wheal Vor

Godolphin and Godolphin Mining (UK) Limited entered into an option agreement dated 9 May 2023 (the “GWV Option Agreement”), pursuant to which Godolphin Mining (UK Limited) has granted to Godolphin the exclusive right to explore the Duke of Leeds Mineral Rights Estate for a term of 120 months, which can be extended for a further 120 months, in order to assess the economic potential of the Property’s and to quantify mineral reserves. Mark Thompson, Henry Maxey and David Lilley are shareholders in both companies. Godolphin may conduct exploration work including, but not limited to, geological and geophysical surveys, drilling, excavations, use of explosives, pits, mineral sampling for laboratory analysis, samples for metallurgical tests and other supplementary works required to explore the Duke of Leeds Mineral Rights Estate. Pursuant to the GWV Option Agreement, Godolphin Mining (UK) Limited has granted to Godolphin the right to enter into a Mineral Lease over the Duke of Leeds Mineral Rights Estate, at any time (the “GWV Option”). In consideration for the maintenance and ultimate exercise of the GWV Option, Godolphin is obligated to pay to Godolphin Mining (UK) Limited the following unindexed amounts (plus any applicable VAT):

| Year |

Annual License Fee (£) |

| 1 |

25,000 |

| 2 |

25,000 |

| 3 |

50,000 |

| 4 |

50,000 |

| 5 |

75,000 |

| 6 |

75,000 |

| 7 |

75,000 |

| 8 |

100,000 |

| 9 |

100,000 |

| 10 |

100,000 |

| Total |

675,000 |

As at the date of this Document, Godolphin has made payments amounting, in aggregate, to £50,000 (all of which was taken as shares in Godolphin) in relation to the Option Agreement.

Mineral Lease Terms

Upon the exercise of the option and the entering into a Mineral Lease the following commercial terms will apply:

• An indexed annual certain rent of £100,000 per annum – this to be deductible against royalty payments

• 2.5% Net Smelter Return Royalty on tin when the price is below $30,000 per tonne

• 3.5% Net Smelter Return Royalty on tin when the price is between $30,000 and $35,000 per tonne

• 4.5% Net Smelter Return Royalty on tin when the price is above $35,000 per tonne

• 2.5% Net Smelter Return Royalty on copper when the price is below $10,000 per tonne

• 3.5% Net Smelter Return Royalty on copper when the price is between $10,000 and $15,000 per tonne

• 4.5% Net Smelter Return Royalty on copper when the price is above $15,000 per tonne

• 10% Net realizable Value on any lithium concentrate

• 3.5% Net Smelter Return on any other metallic mineral, excluding gold and silver

• 5% on the general return for non-metallic minerals and aggregates

A High Grade Tin Vein

In January 2020 Godolphin acquired an option over the Duke of Leeds Minerals Right Estate in Cornwall.

*Old working projected to surface in various colours

**Godolphin Mineral Rights outlined in white

Note: many old mines terminate on anthropogenic mineral rights boundaries, not geological boundaries.

Godolphin has secured the mineral rights over the downward and northward continuation of the Great Wheal Vor Main Lode, a historically significant mining asset. This lode was the second-richest tin mine in Cornwall during the 19th century behind South Crofty / Docoath, with reported widths of up to 10 meters and tin (Sn) grades exceeding 5.0%. Operations at Great Wheal Vor ceased in the early 20th century, not due to exhaustion of ore, but rather because of mineral rights boundaries that prevented further development of the deposit.

Historically, mining was confined to the overlying metasediment formations (locally known as killas). However, tin mineralization is believed to have originated from the underlying granite, which itself may host significant mineralization. This is usual in Cornwall. This presents an opportunity to explore deeper, unmined zones that could contain high-grade tin deposits.

Godolphin's current exploration strategy is focused on the potential continuation of tin mineralization below the historic workings, targeting depths exceeding 500 meters. This represents a largely unexplored opportunity to expand on the rich legacy of the mine. Adjacent to this project area, Cornish Tin is conducting exploration on the southern boundary, further highlighting the regional interest and potential of this prolific mining district.

Great Wheal Vor – Drill Program

Godolphin is planning a focused drilling program at the Great Wheal Vor site, comprising 3 to 5 drill holes from a single location, reaching depths of up to 700 meters. The primary objective of this program is to investigate the depth continuation and potential of the tin mineralization associated with the Wheal Vor lode. The drill program is expected to take 2 to 3 months to complete, with all preparatory studies and stakeholder meetings already conducted satisfactorily.

The necessary General Permitted Development Order (“GPDO”) is prepared and ready for immediate submission, and land access terms have been successfully agreed upon, ensuring smooth progression to the operational phase. While the drilling may intersect several sub-parallel mineralised structures, these narrower structures are considered of secondary importance compared to the primary target. This program is a critical step in assessing the unmined potential of one of the most historically significant tin deposits in the region.

Unaudited financial information on Godolphin

As a small company, Godolphin has previously taken advantage of the exemptions available under the Act to not undertake an audit of its accounts. According to the unaudited management accounts of Godolphin for the nine month period ended 31 December 2024, Godolphin had a turnover of nil and made a loss before tax of £99,133. At 31 December 2024 cash at bank amounted to £18,832 and net current assets amounted to £91,875.

Mineral Resource and Mineral Reserve Estimates

There are no current mineral resource estimates and the Company is not treating the historical estimates detailed above as current mineral resources.

Costs and expenses

The Company is not raising any funds in connection with this Proposed Acquisition and accordingly, there are no proceeds. The costs of the Proposed Acquisition, which are estimated at £80,000, are being met through the transfer of the Titeline Shares at the issue price amounting and cash from existing Company resources amounting to approximately £40,000.

Strategy of the Enlarged Group

The Company will continue to progress its joint venture in respect of Specimen Hill and expects to announce further progress following drilling results in the future. In the meantime, assuming completion of the Proposed Acquisition, the Company’s principal efforts will be focused on making progress in respect of its assets in Devon and Cornwall.

The Company also intends to continue to execute its acquisition strategy. The Company intends to continue selectively pursuing strategic acquisitions that it believes can be effectively integrated with its properties or overall strategic vision although no acquisition opportunities are currently under consideration. The Company believes that its management’s past experience in mergers and acquisitions and other critical areas provides the Company with the necessary skills and experience to effectively identify and evaluate acquisition opportunities. All potential future acquisitions, joint ventures and partnerships will be subject to satisfactory completion of comprehensive due diligence by the Company.

Further information on the Proposed Acquisition, Godolphin and the resolutions to be proposed at the AGM (the "Resolutions") can be found in the Rule 9 Waiver Circular and the Notice of Annual General Meeting set out therein, which will be shortly available on the Company's website at www.tectonicgold.com and will be posted shortly to Shareholders.

Directors and Proposed Board Changes

Following Completion, Jonathan Robbeson will resign from the Board. The Company would like to express their thanks to Jon for the contribution he has made to the Company over many years. Bruce Fulton will also be stepping down from the Board and is pleased that the Company is entering into this merger, confident that it will open exciting possibilities for our Shareholders.

Mark Thompson, CEO of Godolphin will join the Board as CEO alongside Brett Boynton and Sam Quinn who collectively will be the Proposed Directors.

The profiles of the Proposed Directors of the Company following Completion, are set out below:

Robert (“Brett”) Boynton (Non-Executive Chairman)

Brett was previously the Chief Executive Officer of Tectonic and will become the Non-Executive Chairman.

Brett is an experienced entrepreneur and corporate financier with expertise as an investment banker in capital markets, mergers, acquisitions and private equity, including leadership positions at Credit Suisse, FBR Capital Markets and UBS.

Brett has focused on project development in the resources industry, having founded and funded several Australian resource companies including DEI Ltd, Signature Gold Ltd, Chrysos Corporation Limited and Tellus Holdings Ltd. Brett currently heads up the joint venture partner of Agripower Australia Limited, a private equity backed industrial minerals company focused on silicon products. He is also the founder and CEO of DryFlow Magnetics Pty Ltd a private mining technology business upgrading low grade iron ores to green steel input grade and decarbonizing steel fabrication.

Brett holds an undergraduate degree in Economics and Accounting from the University of Cape Town, an MBA from Duke University and is a CFA charter holder. He is a serial seed investor in environmental technologies in the mining and agriculture sectors and a supporter of animal welfare charities.

Mark Edward Thompson (Chief Executive Officer)

Mark is a highly experienced trader in metal derivatives and physical commodities, mining investor and entrepreneur. He has founded (and listed) several mineral exploration companies in the natural resources sector and he has also acted as an expert witness in high-profile metals and mining related commercial disputes.

He is the former Chief Investment Officer and co-founder of Galena Asset Management Ltd, the fund management arm of Trafigura, and then latterly a partner at Apollo Management, one of the world’s largest alternative asset managers.

He holds an B.A. in Physics from Oxford University, is married with two children and lives just outside of London.

Sam Quinn (Non-Executive Director and Company Secretary)

Sam is a corporate lawyer with over 20 years of experience in the natural resources sector, in both legal counsel and executive management positions. Mr. Quinn is currently a partner of Silvertree Partners, a London-based corporate services company dedicated to the natural resources sector and holds various other positions in both listed and private natural resource companies.

Prior to this, Sam worked as the legal counsel to the Dragon Group, a London-based mining venture capital firm, as a corporate lawyer for Jackson McDonald Barristers & Solicitors in Perth, Western Australia and for Nabarro LLP in London.

Sam graduated from the University of Western Australia in 1999 with a Bachelor of Laws and Bachelor of Arts and is a qualified lawyer in Western Australia and in England & Wales.

Information on the Concert Party

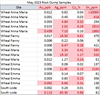

The table below details the interests of the Concert Party following Completion.

| Name |

Number of Shares held in Tectonic |

Percentage Shares currently held in Tectonic |

Consideration Shares acquired |

Existing Ordinary Shares in Lieu of fees (Titeline Shares) |

Number of Ordinary Shares, Consideration Shares and existing Ordinary shares for fees |

Godolphin Warrants converted to Tectonic Warrants |

Maximum number of Shares the Concert Party will hold if Tectonic Warrants are exercised |

Maximum Percentage of Shares held if only Concert Party exercise Tectonic Warrants |

| Mark Thompson |

- |

- |

350,000,000 |

- |

350,000,000 |

- |

350,000,000 |

12.10% |

| David Lilley |

- |

- |

373,437,500 |

- |

373,437,500 |

468,750 |

373,906,250 |

12.93% |

| Henry Maxey |

- |

- |

367,187,500 |

- |

367,187,500 |

468,750 |

367,656,250 |

12.71% |

| Godolphin Minerals Ltd |

- |

- |

113,440,000 |

- |

113,440,000 |

1,562,500 |

115,002,500 |

3.98% |

| Andrew Dacey |

- |

- |

76,500,000 |

- |

76,500,000 |

937,500 |

77,437,500 |

2.68% |

| VSA Capital |

18,781,816 |

1.96% |

41,250,000 |

21,650,000

|

81,681,816 |

- |

81,681,816 |

2.82% |

| Andrew Monk |

22,972,526 |

2.40% |

32,500,000 |

- |

55,472,526 |

25,000 |

55,497,526 |

1.92% |

| Joel Parsons |

|

- |

6,250,000 |

- |

6,250,000 |

- |

6,250,000 |

0.22% |

| Gavin Casey |

9,090,909 |

0.95% |

3,125,000 |

- |

12,215,909 |

- |

12,215,909 |

0.42% |

| Andrew Raca |

3,636,362 |

0.38% |

1,875,000 |

- |

5,511,362 |

- |

5,511,362 |

0.19% |

| Total Concert Party |

54,481,613 |

5.69% |

1,365,565,000 |

21,650,000 |

1,441,696,613 |

3,462,500 |

1,445,159,113 |

49.96% |

Proposed Debt to Equity Conversion and the issue of New Ordinary Shares

The Current Directors of the Company are owed £150,000 for deferred Director fees and salaries. This amount will be converted to 100,000,000 New Ordinary Shares.

In addition loans due to the Current Directors amounting to £221,302 will be repaid in cash at a date to be agreed upon.

The Titeline Shares

In 2018 the Company paid Titeline Drilling Pty Ltd ACN in Tectonic shares (“Titeline Shares”) for future drilling amounting to 10,000 meters of diamond drilling to produce core samples for analysis, assay and metallogenic studies from the Company’s Specimen Hill Project site near Biloela, Queensland. A review was to be completed after 2,500 metres of drilling had been completed. However, the completion programme required to be mutually agreed prior to the credit being applicable to the remaining 7,500 metres had not been produced and until such time as this programme had been produced, this credit could not be utilised. As at 30 June 2024, the balance of the prepayment to Titeline amounted to £327,952 (A$625,386) (the “Prepayment”). On 10 April 2025, The Company entered into the Titeline Settlement Agreement whereby in consideration for the Prepayment being cancelled, Titeline transferred 26,650,000 outstanding Titeline Shares to VSA Capital and Orana Capital in settlement of fees due to them.

VSA Capital, which is a member of the Concert Party, will receive 21,650,000 Titeline Shares in consideration for its services in connection with the Proposed Acquisition and its role as AQSE Corporate Adviser. Orana Corporate will receive 5,000,000 Titeline Shares in consideration for its services as Financial Adviser in connection with the Proposed Acquisition.

Proposed Share Consolidation

Following the issue of the New Ordinary Shares to the Directors in respect of the Debt to Equity Conversion, the Company’s Existing Ordinary Shares prior to the Proposed Acquisition will increase to 1,057,188,591 Ordinary Shares. Following the issue of 1,832,127,500 Consideration Shares in respect of the Proposed Acquisition, the Company’s number of Ordinary Shares in issue will comprise 2,889,316,091, the total number of Ordinary Shares, New Ordinary Shares and Consideration Shares prior to the Consolidation.

A resolution will be proposed to implement a share consolidation on a 20:1 basis whereby Shareholders will receive one Consolidated Ordinary Share for every 20 Existing Ordinary Shares or New Ordinary Shares held on the Record Date. In addition, to ensure that the Share Consolidation is divisible by 20, the Company will issue 9 New Ordinary Shares to the Company Secretary, Sam Quinn.

The total number of shares in issue will therefore reduce from 2,889,316,100 to 144,465,805. The Share Consolidation is expected to improve marketability and consequently as a result, improve the valuation of the Company’s shares. The proportion of each shareholder’s ownership will remain unchanged.

No Shareholder will be entitled to a fraction of a Consolidated Ordinary Share. Instead, their entitlement will be rounded down to the nearest whole number of Consolidated Ordinary Shares. If a Shareholder holds fewer than 20 Existing Ordinary Shares at the Record Date, such that the rounding down process results in a Shareholder being entitled to zero Consolidated Ordinary Shares, then as a result of the Share Consolidation they will cease to hold any Ordinary Shares (of any description) in the capital of the Company.

Remaining fractional entitlements to Consolidated Ordinary Shares will be aggregated and sold on behalf, and for the benefit, of the Company. Under the Company's articles of association, the Directors have a discretion as to how to deal with fractional entitlements, including by accounting to Shareholders for the net proceeds of any sale. The maximum fractional entitlement that any Shareholder would be entitled to would be worth only 3p and so, given the cost of remitting the net proceeds of sale to Shareholders, the Directors believe that the most sensible approach is to apply the net proceeds of sale for the benefit of the Company.

For the avoidance of doubt, the Company is only responsible for dealing with fractions arising on registered holdings. For Shareholders whose Existing Ordinary Shares are held in nominee accounts of UK stockbrokers, the effect of the Share Consolidation on their individual shareholdings will be administered by the stockbroker or nominee in whose account the relevant Existing Ordinary Shares are held. The effect is expected to be the same as for shareholdings registered in beneficial names, however, it is the stockbroker's or nominee's responsibility to deal with fractions arising within their customer accounts, and not the Company's responsibility

Shareholders holding share certificates in respect of their Existing Ordinary Shares in the Company will be sent a new share certificate evidencing the Consolidated Ordinary Shares to which they will be entitled under the Share Consolidation. Such certificates are expected to be despatched by 19 May 2025.

CREST accounts will be credited with the Consolidated Ordinary Shares on implementation of the Share Consolidation on 13 May 2025 or as soon as practicable after the Share Consolidation becomes effective.

Following the Share Consolidation, the Company’s new SEDOL code will be BTXXYC8 and its new ISIN code will be GB00BTXXYC84.

Proposed Change of Name of the Company to Tamar Minerals plc

In order to reflect the strategy of the Enlarged Group and conditional on approval of the resolutions that will enable the Proposed Acquisition to proceed, the Board proposes to change the name of the Company to Tamar Minerals plc. The passing of a Resolution at the Annual General Meeting will give effect to the name change.

The Company’s share ‘ticker’ (Tradeable Instrument Display Mnemonic or “TIDM”) will also change to TMR.

Expected Timetable of Principal Events

| Publication of the Circular and Notice of AGM |

14 April 2025 |

| Latest time and date for receipt of Forms of Proxy and Electronic Proxy Appointments for the Annual General Meeting |

8.00 a.m. on 8 May 2025 |

| Time and date of the Annual General Meeting |

8.00 a.m. (UK time) / 5.00 p.m. (AEST) on 12 May 2025 |

| Completion of Acquisition |

10.00 a.m. on 12 May 2025 |

| Board Minutes allotting the New Ordinary Shares and Consideration Shares |

Before 6.00 p.m. on 12 May 2025 |

| Change of Name to Tamar Minerals Plc |

12 May 2025 |

| Record Date of Share Consolidation |

6.00 p.m. on 12 May 2025 |

| Admission of Consolidated Shares to Trading on Aquis and new Ordinary Shares credited in CREST |

13 May 2025 |

| Issue of the new Ordinary Share Certificates |

By 28 May 2025 |

| *Unless otherwise stated, all references to time are to British Summer Time (UK time) |

|

Key Statistics

| Number of Existing Ordinary Shares of 0.01 pence in issue |

957,188,591 |

| Issue price per Consideration Share |

0.2 pence |

| New Ordinary Shares of 0.01 pence to be issued to Directors in respect of the Debt-to-Equity Conversion |

100,000,000 |

| Consideration Shares of 0.01 pence to be issued in respect of the Proposed Acquisition |

1,832,127,500 |

| Consideration Shares as a percentage of the Enlarged issued Share Capital |

63.41% |

| Issue of New Ordinary Shares to enable the share capital of the Company immediately prior to the Share Consolidation to be divisible by 20 |

9 |

| Total Number of Ordinary Shares, New Ordinary Shares and Consideration Shares prior to Share Consolidation (all with a nominal value of 0.01 pence) |

2,889,316,100 |

| The Concert Party's total number of Ordinary Shares, New Ordinary Shares and Consideration Shares prior to Consolidation |

1,441,696,613 |

| The Concert Party's total percentage of Ordinary Shares, New Ordinary Shares and Consideration Shares prior to Consolidation |

49.90% |

| Number of Tectonic Warrants to be held by the Concert Party |

3,462,500 |

| The Concert Party’s Maximum number of Shares held including Ordinary Shares, New Ordinary Shares, Consideration Shares and Tectonic Warrants prior to Consolidation |

1,445,159,113 |

| The Concert Party Maximum percentage holding of the total number of Ordinary Shares, New Ordinary Shares, Consideration Shares and Tectonic Warrants |

49.96% |

| Consolidated Ordinary Shares of 0.2 pence following the 20:1 Share Consolidation |

144,465,805 |

The Company’s SEDOL code is B9276C5 and ISIN code is GB00B9276C59. Following the Share Consolidation, the Company’s new SEDOL code will be BTXXYC8 and its new ISIN code will be GB00BTXXYC84.

Notice of Annual General Meeting

The Annual General Meeting will be held at 8.00 a.m. (UK time) / 5.00 p.m. (AEST) on 12 May 2025 at Level 3. 66 Hunter Street. Sydney. 2000. NSW. Australia. Details of the resolutions for consideration will be detailed in the Circular to Shareholder’s and will capable of being downloaded from the Company's website: www.tectonicgold.com

Brett Boynton CEO of Tectonic, commented:

“The Tectonic team is very pleased after an extensive search to find such an exciting partnership opportunity, just as the tin market makes headlines for supply complications. Mark and his team have a very similar technology forward approach to exploration and resource delineation and we are looking forward to working with them on unlocking the value in this remarkable portfolio. With the progress on our Australian farm-out and successful divestment of the mineral sands interest, we are now focused on building a world class critical minerals holding with the Godolphin team”.

Mark Thompson CEO of Godolphin, commented:

“We are pleased to be combining with Tectonic who share our vision for the potential of the Company in South West England. Tamar Minerals will benefit from the existing assets in the enlarged group as we seek to progress our tin and copper interests which have considerable potential”.

The Directors of the Company accept responsibility for the contents of this announcement. For further information, please contact:

Tectonic Gold plc +61 2 9241 7665

Brett Boynton (Managing Director)

Sam Quinn (Company Secretary)

Aquis Corporate Adviser and Broker

VSA Capital Limited +44 20 3005 5000

Andrew Raca (Corporate Finance)

Andrew Monk (Corporate Broking

Financial Adviser

Orana Corporate LLP +44 203 475 6834

Sarah Cope

Definitions

The following definitions apply throughout this Document, unless the context requires otherwise:

| Act |

means the Companies Act 2006 (as amended) |

| AGM or Annual General Meeting |

means the annual general meeting of the Company convened at Level 3. 66 Hunter Street. Sydney. 2000. NSW. Australia at 8.00 a.m. (UK time) / 5.00 p.m. (AEST) on 12 May 2025 by the Notice of AGM and any adjournment thereof |

| Aquis or AQSE |

means Aquis Stock Exchange |

| Acting in Concert |

has the meaning attributed to it in the Takeover Code |

| Articles |

means the existing articles of association of the Company as at the date of this Document |

| Board |

means the board of directors of the Company from time to time |

| Business Day |

means any day (excluding Saturdays and Sundays) on which banks are open in London for normal banking business and the London Stock Exchange is open for trading |

| Company or Tectonic |

means Tectonic Gold plc |

| Completion |

means completion of the Proposed Acquisition following approval of Independent Shareholders at the Annual General Meeting |

| Concert Party |

means shareholders of Godolphin who are connected: David Lilley, Henry Maxey, Mark Thompson, Godolphin Minerals Ltd, Andrew Dacey, VSA Capital, Andrew Monk, Joel Parsons, Gavin Casey and Andrew Raca |

| Consideration Shares |

means the 1,832,127,500 new Ordinary Shares to be issued to the Godolphin Shareholders upon Completion. |

| Consolidated Ordinary Shares |

means Ordinary Shares of 0.2 pence each following the 20:1 Consolidation of Existing Ordinary Shares of 0.01 pence |

| Current Directors |

means the directors of the Company at the date of this Document whose names are Bruce Fulton, Brett Boynton, Jonathan Robbeson and Sam Quinn |

| Document |

this document |

| Existing Ordinary Shares |

means the 957,188,591 existing Ordinary Shares at the date of this Document |

| Enlarged Issued Share Capital |

means the Share Capital of the Company as in Enlarged by the issue of the Consideration Shares and the New Ordinary Shares and following the Share Consolidation |

| FCA |

means the Financial Conduct Authority of the United Kingdom |

| Godolphin |

means Godolphin Exploration Limited |

| Godolphin Shareholders |

means the shareholders of Godolphin |

| Godolphin Warrant |

means, together the warrants over 4,400,000 and 1,170,000 shares Godolphin. Granted by Godolphin to the Godolphin Warrant Holders |

| Godolphin Warrant Holders |

means the holders of the Godolphin Warrants |

| Group |

means the Company and its subsidiaries and subsidiary undertakings |

| Independent Shareholders |

means shareholders who are eligible to vote on the Waiver Resolution |

| Notice of AGM |

means the notice of the AGM set out at the end of this Document |

| New Ordinary Shares |

means the 100,000,000 Ordinary Shares issued to the Directors in repayment of debts owed by the Company to them in respect to the Proposed Debt to Equity Conversion together with 9 Ordinary Shares to be issued immediately prior to the Share Consolidation |

| Orana Corporate LLP |

means Orana Corporate LLP, Financial Adviser to the Company |

| Ordinary Shares |

means ordinary shares of 0.01 pence each in the capital of the Company |

| Panel or Takeover Panel |

means the Panel on Takeovers and Mergers |

| Proposed Acquisition |

means the acquisition the entire issued share capital of Godolphin |

| Proposed Directors |

means the directors of the Company following completion, whose names are Mark Thompson, Brett Boynton and Sam Quinn |

| Proposed Debt to Equity Conversion |

the proposed conversion of £150,000 debt in respect of deferred Director fees and salaries into 100,000,000 New Ordinary Shares |

| Record Date |

means 12 May 2025, |

| Registrar or MUFG Corporate Markets |

MUFG Corporate Markets, Central Square, 29 Wellington Street, Leeds, LS1 4DL |

| Resolutions |

the proposed Shareholder resolutions as set out in the notice of Annual General Meeting |

| Rule 9 |

means Rule 9 of the Takeover Code |

| Share Consolidation |

means the 20:1 Consolidation of Existing Ordinary Shares of 0.01 pence. |

| Shareholders |

means holders of Existing Ordinary Shares of Tectonic |

| Subsidiary |

means a subsidiary undertaking as that term is defined in the Act |

| Takeover Code or Code |

means the City Code on Takeovers and Mergers |

| Tectonic or the Company |

means Tectonic Gold plc |

| Tectonic Warrants |

means, together the warrants over 5,500,000 Ordinary Shares granted by the Company and exercisable at 8 pence for the period ended 31 January 2029 and the warrants over 1,462,500 Ordinary Shares and exercisable at 10 pence for the period ended 31 May 2029 to be issued to the Godolphin Warrant Holders upon Completion |

| Titeline |

Titeline Drilling Pty Ltd ACN |

| Titeline Settlement Agreement |

The agreement with Titeline whereby the Titeline Shares will be transferred to creditors of Tectonic in settlement of sums due |

| Titeline Shares |

The 26,650,000 Existing Ordinary Shares in Tectonic held by Titeline |

| United Kingdom or UK |

means the United Kingdom of Great Britain and Northern Ireland |

| £ or Pounds |

means UK pounds sterling, being the lawful currency of the United Kingdom |

| VSA Capital |

means VSA Capital Limited of Park House, 16-18 Finsbury Circus, London EC2M 7EB, the AQSE corporate adviser and broker to the Company |

| Waiver |

means the waiver by the Panel of any requirement under Rule 9 of the Takeover Code for the Concert Party to make a general offer to Shareholders for the Company which would otherwise arise as a result of the issue of the Consideration Shares |

| Waiver Resolution |

means Resolution 6 to be proposed at the General Meeting as set out in the Notice of AGM |